Russia bombards Ukraine hours before key meeting on Trump NATO weapons deal

Crypto Market Recap: Metaplanet Buys 1,005 Bitcoin, Plans US$208M Bond to Fund More BTC

Here’s a quick recap of the crypto landscape for Friday (June 27) as of 9:00 a.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ethereum price update

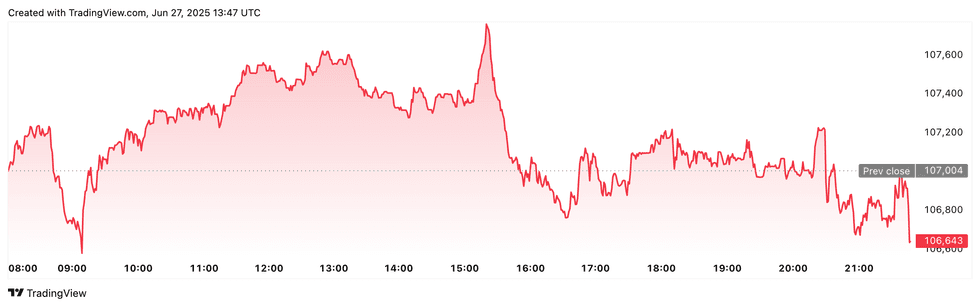

Bitcoin (BTC) is priced at US$107,027, trading flat in the last 24 hours. The day’s range for the cryptocurrency brought a low of US$106,709 and a high of US$107,884.

Bitcoin price performance, June 27, 2025.

Chart via TradingView.

Ethereum (ETH) closed at US$2,449.37, trading flat over the past 24 hours. Its lowest valuation on Friday was US$2,402.46 and its highest valuation was US$2,459.96 at the opening bell.

Altcoin price update

- Solana (SOL) was priced at US$142.26, down 0.6 percent over 24 hours. Its highest valuation as of Friday was US$143.46, and its lowest was US$143.46.

- XRP was trading for US$2.10, down by 1.3 percent in 24 hours. The cryptocurrency’s highest valuation was US$2.08, and its lowest price on Wednesday was US$2.14.

- Sui (SUI) is trading at US$2.63, showing an increaseof 1.4 percent over the past 24 hours. Its lowest valuation was US$2.59, and its highest valuation was US$2.67.

- Cardano (ADA) is priced at US$0.5580, trading flat in the last 24 hours. Its highest valuation as of Friday was US$0.5631, and its lowest was US$0.5496.

Today’s crypto news to know

Trump’s World Liberty adds UK DeFi partner, eyes stablecoin vault

World Liberty Financial, the crypto venture connected to Donald Trump’s family, has secured a partnership with Re7 Capital, a London-based decentralized finance hedge fund, in a bid to scale its USD1 stablecoin.

Backed by up to US$10 million in investment from Hong Kong’s VMS Group, Re7 Capital will work with World Liberty on deploying a stablecoin vault on the Euler and Lista protocols, while also expanding to Binance’s BNB Chain.

VMS Group, a family office for wealthy Hong Kong clients, is making its first crypto move through its stake in Re7.

Meanwhile, the Middle East’s Aqua 1 Foundation disclosed a US$100 million investment into World Liberty tokens, becoming its largest single investor.

UAE’s Aqua 1 buys US$100 million of Trump’s World Liberty Tokens

The Aqua 1 Foundation, a relatively low-profile fund based in the United Arab Emirates, confirmed a US$100 million purchase of World Liberty tokens, linked to Donald Trump’s family-backed crypto initiative.

The tokens, known as $WLFI, function as governance tokens, meaning holders vote on protocol changes but cannot yet freely trade them. World Liberty said it hopes to eventually allow these tokens to become transferable.

The partnership will also help identify and develop blockchain projects across South America, Europe, and Asia. The fund also plans to launch a separate vehicle to advance Middle East digital economic initiatives using blockchain and artificial intelligence.

Despite the investment, Aqua 1 maintains a very minimal online footprint, with only three posts on X and a website registered just weeks ago.

World Liberty says Aqua 1’s teams will support its compliance and expansion efforts going forward.

Bitcoin logs weakest monthly growth despite strong ETF flows

Bitcoin’s performance is stalling despite massive inflows to spot ETFs, pointing to shifting market forces.

The leading crypto asset has climbed just 2 percent for the month, marking its smallest gain since July 2023, even with US$3.9 billion in inflows over recent weeks.

Data shows that whales holding over 10,000 BTC have leaned toward selling, dampening bullish momentum. Smaller wallets have also been net sellers, further pressuring prices as opportunistic traders take profits.

Between January and April, most market participants had offloaded assets until accumulation restarted near US$76,000 in April.

Now, Bitcoin is consolidating with realized profits in the current cycle hitting US$650 billion, higher than last cycle’s $US550 billion.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.