Crypto Market Update: Bitcoin Dips Below US$100K, Ripple Raises US$500M

Here’s a quick recap of the crypto landscape for Wednesday (November 5) as of 9:00 a.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ether price update

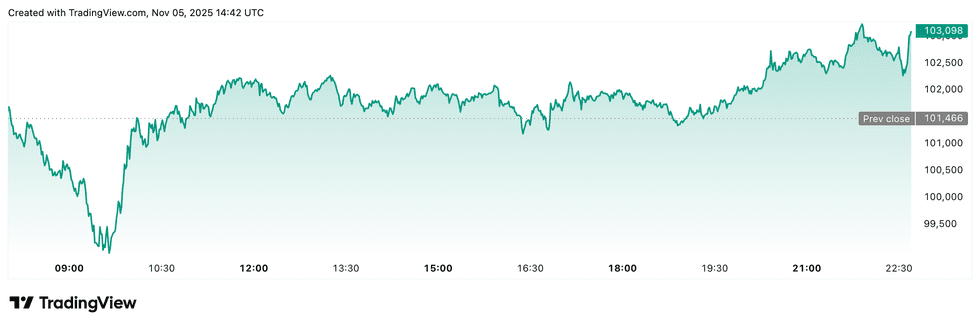

Bitcoin (BTC) was priced at US$101,721, a 0.8 percent decrease in 24 hours. BTC’s lowest valuation today was US$99,075.89, and its highest was US$104,666.

Bitcoin price performance, November 5, 2025.

Chart via TradingView.

Bitcoin is entering November on the defensive after suffering its first negative October in six years, a month traders have now dubbed “Red October’.

The correction pulled prices below key technical levels and has raised questions about whether the downturn marks the start of a deeper bear phase or simply a healthy reset before the next rally.

Overall sentiments point to a shaky market momentum remains in the near term. According to trader Ted Pillows, Bitcoin’s upcoming weekly close will be decisive: if Bitcoin manages to close the week above the EMA-50 with strong buying activity, it could confirm that prices have bottomed out. However, if it finishes below that threshold, it may signal that the downturn is only starting.

Furthermore, Bitcoin has slipped below US$100,000 with losses over the past 48 hours climbing past 8 percent, its sharpest two-day decline in nine months. Data shows more than 235,000 BTC, which are worth roughly US$24 billion, were moved at a loss in the last 24 hours due to intensified panic selling.

Whether Bitcoin stabilizes or extends its descent will depend largely on investor reaction in the coming days. If traders view the current dip as an entry point rather than an exit signal, analysts anticipate that November could lead to a swift turnaround.

Ether (ETH) was priced at US$3,301.90, a 5.8 percent decrease in 24 hours. Its lowest valuation of the day was US$3,097.71, while its highest was US$3,576.09.

Altcoin price update

- Solana (SOL) was priced at US$155.60, down 3.2 percent over the last 24 hours. Its lowest valuation of the day was US$147.97, while its highest was US$164.71.

- XRP was trading for US$2.22, a decrease of 1.7 percent over the last 24 hours. Its lowest valuation of the day was US$2.09, and its highest was US$2.32.

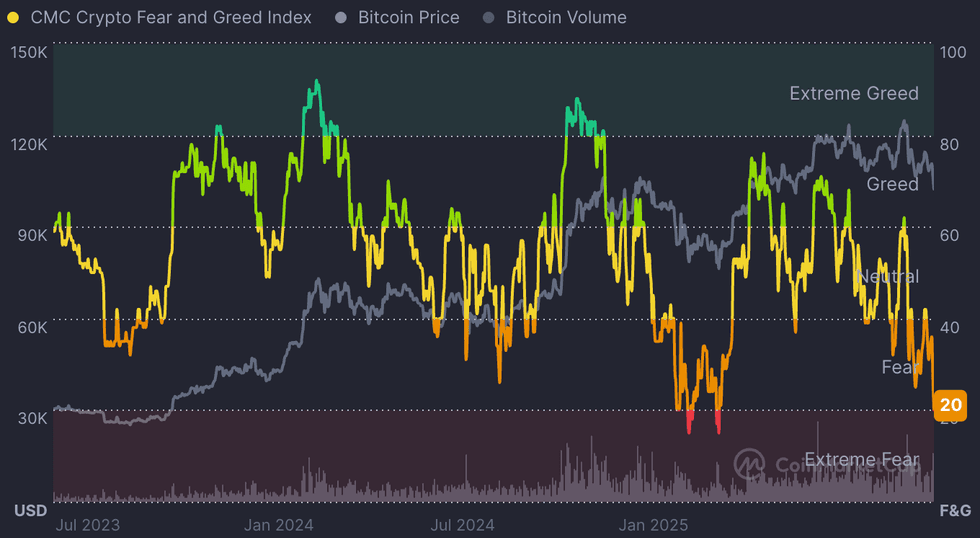

Fear and Greed Index snapshot

CMC’s Crypto Fear & Greed Index shows the continued deterioration of the current market sentiment, slipping down to 20 and further into ‘extreme fear’ territory as the chart dropped by -7 points overnight.

Bitcoin itself has fallen almost 2 percent overnight, sitting roughly 19 percent below its October 7 all-time high of US$126,198.07. The cryptocurrency has now lost 10 percent over the past week.

Crypto derivatives and market indicators

Bitcoin derivatives metrics suggest traders are leaning cautiously bullish rather than risk-averse.

Liquidations for contracts tracking Bitcoin have totaled approximately US$15.97 million in the last four hours, with the majority being short positions, a sign that bearish bets are being unwound as prices stabilize. Ether liquidations showed a similar pattern, with short positions making up most of the US$16.67 million in total liquidations.

Futures open interest for Bitcoin was up by 2.30 percent to US$69.96 billion over four hours, while Ether futures open interest also gained 2.17 percent to US$39.05 billion, reflecting renewed leverage entering the market.

The funding rate remains positive for both crytocurrencies, with Bitcoin at 0.004 and Ether at 0.002, indicating more overall bullish positioning than bearish.

Bitcoin’s relative strength index stood at 36.50, suggesting that while price momentum remains subdued, it is approaching levels where a rebound could form if buying pressure strengthens.

Today’s crypto news to know

Ripple secures US$500 million boost at US$40 billion valuation

Ripple has raised US$500 million in a new funding round led by Fortress Investment Group and Citadel Securities, valuing the company at US$40 billion.

The investment follows Ripple’s $1 billion tender offer earlier this year at the same valuation, marking a continuation of investor confidence in the firm’s long-term outlook.

Ripple said the funds will strengthen its partnerships with financial institutions and expand its services across custody, stablecoin issuance, and crypto treasury management. The company’s RLUSD stablecoin has gained traction for corporate payments amid clearer US regulations under the GENIUS Act.

The funding also positions Ripple to deepen its role in global payments as more firms integrate stablecoins into settlement networks.

Bitcoin slips below US$100,000 for the first time since June

Bitcoin fell more than 7 percent this week to trade below the US$100,000 mark for the first time since June.

The sharp dip extended a correction that has wiped out over 20 percent from its recent record high. Analysts attribute the decline not to leverage but to sustained selling from long-term holders and large investors.

Research firm 10x found that wallets holding between 1,000 and 10,000 BTC offloaded about 400,000 coins in the past month, worth roughly US$45 billion.

Analysts expect continued pressure through early 2026, though few foresee a full capitulation, with price consolidation likely around the mid-US$80,000 range before any recovery.

Northern Data exits Bitcoin mining in US$200 million AI transition

Northern Data Group, Europe’s largest Bitcoin mining company, is divesting its mining arm, Peak Mining, in a deal worth up to US$200 million as it pivots entirely toward artificial intelligence infrastructure.

The transaction includes US$50 million in upfront cash and up to US$150 million in performance-based payments tied to future profits. The move follows the April 2025 Bitcoin halving, which cut mining revenues in half and accelerated the firm’s strategic shift.

The company plans to repurpose its mining facilities in Texas for high-performance AI workloads, which can yield up to ten times more revenue per megawatt than Bitcoin mining. The company already owns over 220,000 GPUs through prior acquisitions.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.