WATCH: Rubio on Dems saying they regret voting for him: ‘Confirmation I’m doing a good job’

Crypto Market Recap: Bitcoin Price Hits New All-time High, Traders Make US$300,000 Bet

Here’s a quick recap of the crypto landscape for Wednesday (May 21) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ethereum price update

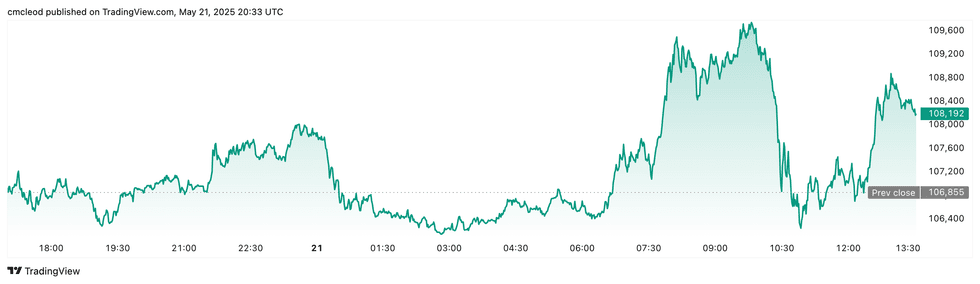

Bitcoin (BTC) was priced at US$108,452 as markets closed, up 1.5 percent in 24 hours. The day’s range for the cryptocurrency brought a low of US$106,490 and a new all-time high of US$109,400.

Bitcoin performance, May 21, 2025.

Chart via TradingView.

Bitcoin surpassed its previous record of US$109,228, set on January 20. Following this peak, the price quickly declined to approximately US$106,000 within an hour, but subsequently stabilized around US$107,000.

Ethereum (ETH) finished the trading day at US$2,507.94, a 0.5 percent increase over the past 24 hours. The cryptocurrency reached an intraday low of US$2,473.89 and saw a daily high of US$2,597.51.

Altcoin price update

- Solana (SOL) closed at US$170.94, up 2 percent over 24 hours. SOL experienced a low of US$167.29 and a high of US$174.24.

- XRP is trading at US$2.39, reflecting a 0.5 percent increase over 24 hours. The cryptocurrency reached a daily low of US$2.35 and a high of US$2.42.

- Sui (SUI) is priced at US$3.91, showing an increaseof 0.9 percent over the past 24 hours. It achieved a daily low of US$3.86 and a high of US$4.04.

- Cardano (ADA) is trading at US$0.7606, up 3 percent over the past 24 hours. Its lowest price of the day was US$0.7487, and it reached a high of US$0.7797.

Today’s crypto news to know

US$300,000 Bitcoin bet gains attention, but remains a long shot

A bold options trade is betting Bitcoin could hit US$300,000 by the end of June.

According to market data, call options at that stratospheric strike price were the second most traded on Deribit on Tuesday (May 20), hinting at a mix of speculative enthusiasm and hedging behavior among traders.

While some analysts remain optimistic — Standard Chartered (LSE:STAN,OTC Pink:SCBFF), for instance, sees Bitcoin possibly reaching US$120,000 by Q2 — no major forecast comes close to US$300,000.

On Tuesday, Bitcoin hovered near US$107,000, not far from its record high of US$109,241 in January.

Still, market experts caution that without a strong catalyst, the current rally may not sustain its upward trajectory. Betting markets like Polymarket place only a 9 percent chance of Bitcoin hitting even US$250,000 this year, underscoring how isolated this US$300,000 wager truly is.

Bitget becomes world’s third top crypto exchange by trading volume

Bitget has officially surged into third place among global crypto exchanges, reporting US$757.6 billion in futures trading volume and US$68.6 billion in spot volume for April of this year.

The Seychelles-based platform has made a name for itself through features like copy trading, which allows users to mimic high-performing traders in real time. Bitget’s April performance stood out despite a broader market correction, expanding its market share to 7.2 percent and pushing its user base above 120 million. The exchange’s rise signals increasing demand for advanced crypto trading products beyond the traditional buy-and-hold strategy.

CME’s XRP futures launch with US$19 million volume

XRP joined the roster of cryptocurrencies traded on CME Group’s (NASDAQ:CME) derivatives exchange as the firm launched futures contracts that pulled in over US$19 million in notional volume on Sunday (May 18).

The first day’s tally easily eclipsed Solana’s March debut of US$12.3 million, putting XRP alongside BTC, ETH and SOL in CME’s crypto futures lineup. Offered in both micro (2,500 XRP) and standard (50,000 XRP) sizes, the cash-settled contracts allow investors to speculate on XRP’s price without owning the token.

The timing is noteworthy, as the US Securities and Exchange Commission (SEC) continues to drag its feet on pending exchange-traded fund applications for XRP and SOL, leaving futures as the most viable institutional gateway.

XRP futures could see broader uptake if regulatory clarity around token classification progresses. The SEC’s recent legal moves against other issuers may also increase demand for regulated products like these.

Crypto.com and Kraken secure MiFID licenses for European expansion

Crypto.com and Kraken have both secured Markets in Financial Instruments Directive (MiFID) licenses to offer crypto derivatives in Europe. Crypto.com secured its license through the acquisition of A.N. Allnew Investments, a Cyprus-based financial firm. Kraken acquired an unnamed Cypriot investment firm to gain its MiFID license.

A MiFID license allows entities to offer crypto derivatives in the EU. Platforms must meet strict regulations, enabling them to provide complex crypto financial products to more European investors under harmonized EU rules.

The moves underscore the increasing maturity of the cryptocurrency market and the proactive steps exchanges are taking to operate within established legal and financial frameworks in key global jurisdictions.

SEC accuses Unicoin of US$100 million fraud

The SEC has charged crypto firm Unicoin and four top executives with running what it calls a US$100 million securities fraud scheme, alleging the company lied about its assets and sales performance.

According to the complaint, Unicoin misled investors by falsely claiming to own prime real estate in locations like Thailand and Argentina, inflating the value of these assets by over US$1 billion. The company also allegedly exaggerated the sales of its ‘rights certificates,’ stating it had raised US$3 billion when the real figure was just US$110 million.

The SEC is seeking disgorgement and civil penalties, and notes that Unicoin rejected a prior attempt to settle the matter.

CEO Alexander Konanykhin told investors last month that the company had “declined to show up” for an SEC settlement meeting, labeling it an “ultimatum.”

Robinhood proposes tokenized RWA framework

Robinhood Markets (NASDAQ:HOOD) has proposed a 42 page framework to the SEC for national regulation of tokenized real-world assets (RWAs), as reported by Forbes on Tuesday.

The proposal also outlines the creation of the Real World Asset Exchange (RRE), a trading platform that would offer off-chain trade matching and on-chain settlement. To ensure efficiency, transparency and global compliance, the RRE would integrate KYC and AML tools through partnerships with Jumio and Chainalysis.

A central aspect of Robinhood’s proposal is the concept of token-asset equivalence. This would classify tokens representing assets like US Treasury bonds as the underlying asset itself, rather than a derivative.

This approach aims to enable institutions and broker-dealers to manage tokenized RWAs within the current regulatory structure, potentially simplifying custody, trading and settlement procedures.

New Bitcoin accumulation metric

As enterprises continue to build BTC holdings, a new analytical metric, days to cover mNAV, is being used to estimate how long it would take a company to acquire enough BTC to match its market capitalization.

The calculation uses the company’s current multiple of net asset value (mNAV) and its daily BTC yield, incorporating compounding to provide a forward-looking, growth-adjusted valuation.

The formula is: Days to Cover = ln(mNAV) / ln(1 + BTC Yield)

Data from significant Bitcoin-acquiring companies like Strategy (NASDAQ:MSTR), Metaplanet (TSE:3350,OTCQX:MTPLF) and Semler Scientific (NASDAQ:SMLR) between October 2024 and May 2025 indicates an increasingly efficient market that facilitates Bitcoin accumulation for large entities.

The formula was proposed by Adam Back on May 9, and gained traction after being reposted by X user @ActuallyClimber on May 14. CoinDesk reported on its increasing adoption within crypto circles on Wednesday.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.